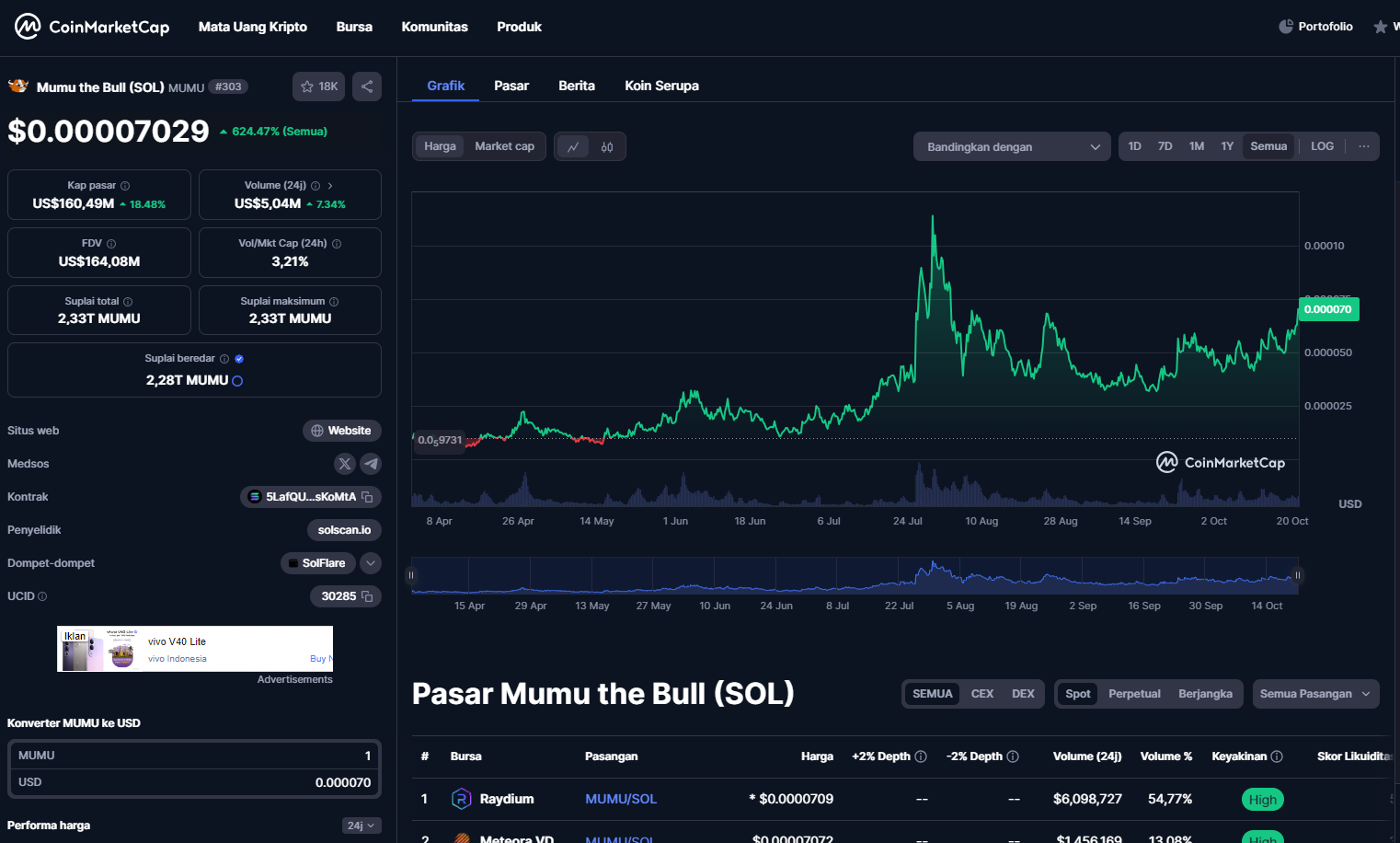

The Reef token (REEF), a popular asset in the cryptocurrency market, has shown a slight upward trend, signaling possible stability following a volatile month. As of October 31, 2024, the token is trading at approximately $0.00158, marking a 2.4% increase in the past 24 hours. The token’s recovery has caught the attention of crypto investors, especially given its sharp fluctuations earlier in the month.

Market Overview and Recent Performance

REEF, currently ranked #613 among cryptocurrencies, has maintained a market capitalization of around $60.89 million with a fully diluted valuation that matches this figure. Over the past 24 hours, the trading volume has surged to approximately $11.92 million, indicating heightened interest and activity among traders. The price range for the day has been between $0.001511 and $0.001632, with the token recovering from recent lows, as depicted on various crypto platforms.

A closer look at the 4-hour REEF/USDT chart reveals that the token recently experienced a strong upward movement followed by a dramatic drop. This high volatility is common in cryptocurrency markets, often influenced by broader market sentiments and sudden large trades. The chart shows several rapid movements over the last few days, with a spike reaching as high as $0.007 before falling back to more stable levels around $0.00158.

RSI Analysis and Trading Signals

The Relative Strength Index (RSI) on the 4-hour chart for REEF currently sits at 50.06, indicating a neutral position in terms of market momentum. Historically, an RSI reading above 70 suggests overbought conditions, while a reading below 30 indicates oversold conditions. The current neutral position suggests that the token could be consolidating, giving investors time to strategize their next moves. The presence of several "Bull" signals, as noted in recent technical analysis, may suggest that bullish trends could be emerging, although the market still shows signs of caution among traders.

Factors Influencing REEF's Recent Volatility

REEF’s recent performance has been influenced by various external and internal factors. On the macroeconomic front, global market uncertainties, regulatory news, and movements in major cryptocurrencies like Bitcoin and Ethereum can directly affect altcoins like REEF. As REEF trades on various decentralized platforms, any shifts in these larger assets tend to reflect on its price.

Moreover, Reef's unique position as a DeFi platform focusing on cross-chain trading and integration with different blockchain ecosystems has attracted significant interest. Reef’s ecosystem aims to simplify decentralized finance (DeFi) processes, making it easier for users to participate in staking, trading, and yield farming across multiple blockchain networks. Despite the token’s relatively low price, the long-term potential of the platform has kept REEF in the spotlight among DeFi and Web3 enthusiasts.

Community and Developer Updates

Reef has continued to foster its community, maintaining active communication channels through Twitter, Telegram, and Discord. The development team has been working on technical upgrades, ensuring that the Reef chain remains competitive within the blockchain ecosystem. The project’s roadmap includes enhancements aimed at expanding Reef’s capabilities in NFTs, metaverse projects, and gaming.

Looking Ahead: Market Predictions and Future Outlook

With the recent signs of stabilization, analysts and investors are closely monitoring REEF’s performance. Given the current market sentiment, the token could see either a breakout above current resistance levels or a retracement to test lower support zones if the broader market sentiment turns bearish. The RSI neutrality suggests room for movement in either direction, making it a potentially attractive asset for traders looking for short-term gains.

In conclusion, Reef's recent 2.4% price increase is a welcome development for the token's holders. As the platform continues its efforts to enhance the DeFi experience and attract more users to its ecosystem, there is cautious optimism about the token's potential. However, investors should remain aware of the high volatility and ensure proper risk management, especially in a market as unpredictable as cryptocurrency.